Data Center Stocks Heat Up

The Week's Top Performers Signal Sector Strength

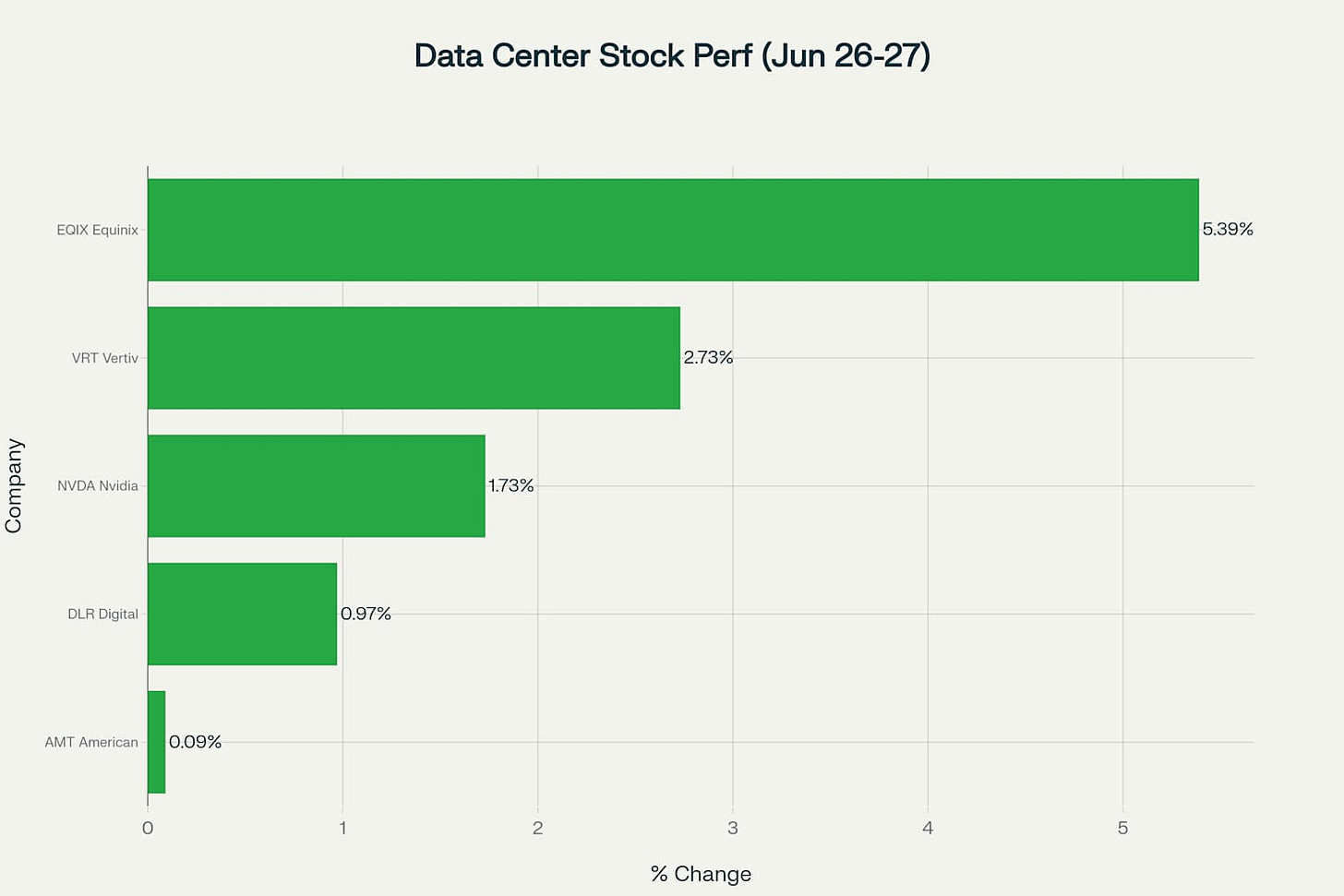

The data center sector delivered impressive gains during the final trading days of June 2025, with several key players posting significant advances that underscore the continued investor appetite for AI infrastructure plays 12. Led by Equinix's remarkable 5.39% surge, the sector demonstrated resilience amid broader market volatility and growing demand for digital infrastructure 34.

Weekly Performance Highlights

Data center stocks across multiple sub-sectors posted solid gains, with infrastructure leaders and REITs taking center stage during the June 26-27 trading period 53. The performance was particularly notable given the sector's already elevated valuations and the ongoing scrutiny of AI-related investments 6.

Data center stock performance showing strong gains led by Equinix and Vertiv

Equinix (EQIX) emerged as the standout performer with a 5.39% two-day gain, climbing from $745.00 to $785.12 47. The data center REIT's strong performance came despite a notable 5.12% pre-market decline ahead of its analyst day, suggesting robust institutional support for the company's long-term growth prospects 4.

Vertiv Holdings (VRT) secured the second position with a 2.73% advance, rising from $123.79 to $127.17 89. The data center infrastructure specialist has been riding a wave of optimism around its thermal management and power distribution solutions, which are critical for AI workloads 108.

Market Capitalization Landscape

The data center ecosystem encompasses companies of vastly different scales, from mega-cap chip designers to specialized infrastructure providers 1112.

Market capitalization comparison of major data center companies showing Nvidia's dominance

Nvidia continues to dominate with a staggering $3.85 trillion market capitalization, reflecting its position as the primary beneficiary of the AI data center boom 1312. The chip giant's data center revenue exploded to $39.1 billion in its latest quarter, representing a 73% year-over-year increase and accounting for the majority of its record-breaking performance 1312.

American Tower Corporation, at $102 billion in market cap, represents the infrastructure backbone supporting both traditional telecom and emerging data center connectivity needs 1415. The company has been expanding its data center footprint through acquisitions, including its purchase of CoreSite, positioning it as a hybrid infrastructure play 16.

Sector Dynamics and Growth Drivers

The data center market is experiencing unprecedented expansion, driven by multiple converging trends 171. The global colocation market alone is projected to surge from $104.2 billion in 2025 to $204.4 billion by 2030, representing a robust 14.4% compound annual growth rate 1.

Artificial intelligence workloads are fundamentally reshaping data center requirements, demanding specialized cooling solutions and power infrastructure that companies like Vertiv provide 31. This shift is creating opportunities for infrastructure specialists while pressuring traditional operators to upgrade their facilities 18.

Financing activity in the sector has reached record levels, with data center financings expected to hit $60 billion in 2025, doubling the $30 billion recorded in 2024 19. This surge in capital deployment reflects both the growth opportunities and the capital-intensive nature of modern data center development 19.

Notable Corporate Developments

Meta Platforms made headlines with reports of seeking $29 billion in funding for AI data center construction 2. The social media giant is reportedly in advanced discussions with a consortium including Apollo, KKR, Brookfield, Carlyle, and PIMCO for this massive infrastructure investment 2.

Equinix continued its global expansion with the completion of its acquisition of three data centers in Manila from Total Information Management, strengthening its Asia-Pacific presence 3. Meanwhile, Vantage Data Centers achieved a European first by securing €640 million through the industry's inaugural euro-based asset-backed securitization 3.

Amazon's commitment to AI infrastructure was evident in its announcement of a $10 billion investment in North Carolina data centers, expected to create 500 jobs while supporting AWS's growing capacity demands 3.

Investment Considerations and Outlook

The sector faces both significant opportunities and notable challenges heading into the latter half of 2025 2018. Power supply constraints represent a critical bottleneck, with data centers consuming 7.4 gigawatts in 2023, a 55% increase from 2022's 4.9 gigawatts 17.

Water stress concerns are emerging as a sustainability issue, with 40% of US data centers located in regions facing severe water stress 3. This environmental challenge could drive investment toward more efficient cooling technologies and alternative data center designs 3.

Valuation metrics suggest mixed signals across the sector 9. Vertiv trades at a 23% premium to its fair value estimate of $103, while analyst price targets for Equinix average $1,013.63, indicating potential upside from current levels 49.

The leasing environment remains robust, with take-up of colocation capacity projected to reach 855MW in 2025, marking a 22% year-over-year increase and the fastest growth rate in four years 3. Most available space is pre-leased until 2027, particularly at large data centers, supporting pricing power for operators 18.

Looking Ahead

Data center stocks appear well-positioned to benefit from the continued digital transformation and AI adoption trends 1718. The sector's performance during the final days of June suggests investor confidence remains strong despite broader market concerns about AI investment sustainability 6.

Key catalysts to monitor include ongoing AI model development, cloud migration trends, and regulatory developments around data sovereignty that could drive demand for domestic data center capacity 1. The sector's ability to secure adequate power and cooling infrastructure will likely determine which companies can capitalize on the growing demand 317.

With financing activity at record levels and demand fundamentals remaining robust, data center stocks continue to represent a compelling investment theme for investors seeking exposure to the AI and cloud computing megatrends 191.

https://finance.yahoo.com/news/data-center-colocation-market-worth-141500751.html

https://siliconangle.com/2025/06/27/report-meta-seeking-raise-29b-ai-data-center-construction/

https://www.xyzreality.com/resources/data-center-rundown-june-2025

https://www.ainvest.com/news/equinix-plunge-5-12-analyst-day-2506/

https://money.usnews.com/investing/articles/best-data-center-stocks

https://www.nasdaq.com/articles/stock-market-news-jun-27-2025

https://www.investing.com/equities/equinix,-inc.-historical-data

https://www.valuewalk.com/investing/best-data-center-stocks/

https://ycharts.com/indicators/nvidia_corp_nvda_data_center_revenue_quarterly

https://www.cnbc.com/2025/05/28/nvidia-nvda-earnings-report-q1-2026.html

https://www.projectfinance.law/publications/2025/june/data-center-financing-structures/

https://www.siacharts.com/2025/06/25/digital-realty-trust-inc-dlr/

https://eulerpool.com/en/stock/Arista-Networks-Stock-US0404132054

https://www.valueresearchonline.com/stocks/293329/cyrusone-inc-cone/

https://www.equitymaster.com/stockquotes/datacenters/list-of-data-centers-sector

https://investor.digitalrealty.com/stock-info/dividend-history/default.aspx

https://www.nasdaq.com/market-activity/stocks/amt/historical