The Data Center Gold Rush: Hot Stocks Exploding as AI Demand Reaches Fever Pitch

The data center sector is experiencing an unprecedented boom, with several stocks posting explosive gains in recent weeks as artificial intelligence infrastructure demand reaches new heights. The global data center market is projected to surge from $344 billion in 2024 to $452.53 billion in 2025, representing a staggering growth trajectory that's creating massive opportunities for savvy investors 1. With US data center financing expected to double from $30 billion to $60 billion this year, we're witnessing the early stages of what could be the most significant infrastructure buildout in modern history 2.

A modern data center building with a grey facade and landscaped entrance novva

Market Dynamics Driving the Surge

The current data center stock rally is being fueled by several converging factors that are reshaping the entire technology landscape 3. Hyperscale companies are racing to build AI infrastructure, with several executives noting that the risks of underinvesting in AI are greater than the risks of overinvesting 4. This sentiment is translating into massive capital commitments, with data center development financing projected to reach $170 billion in asset value requiring either development or permanent financing in 2025 3.

The power requirements alone tell the story of this explosive growth 1. Data centers consumed 7.4 gigawatts of power in 2023, representing a 55% increase from 4.9 gigawatts in 2022 1. Nvidia's data center revenue exploded by 427% year-over-year, jumping from $4.28 billion in Q1 FY2024 to $22.57 billion in Q1 FY2025, making it the dominant contributor to the company's record growth 15.

Global data center market projected to reach $624B by 2029, with US financing doubling to $60B in 2025

This Week's Breakout Stars

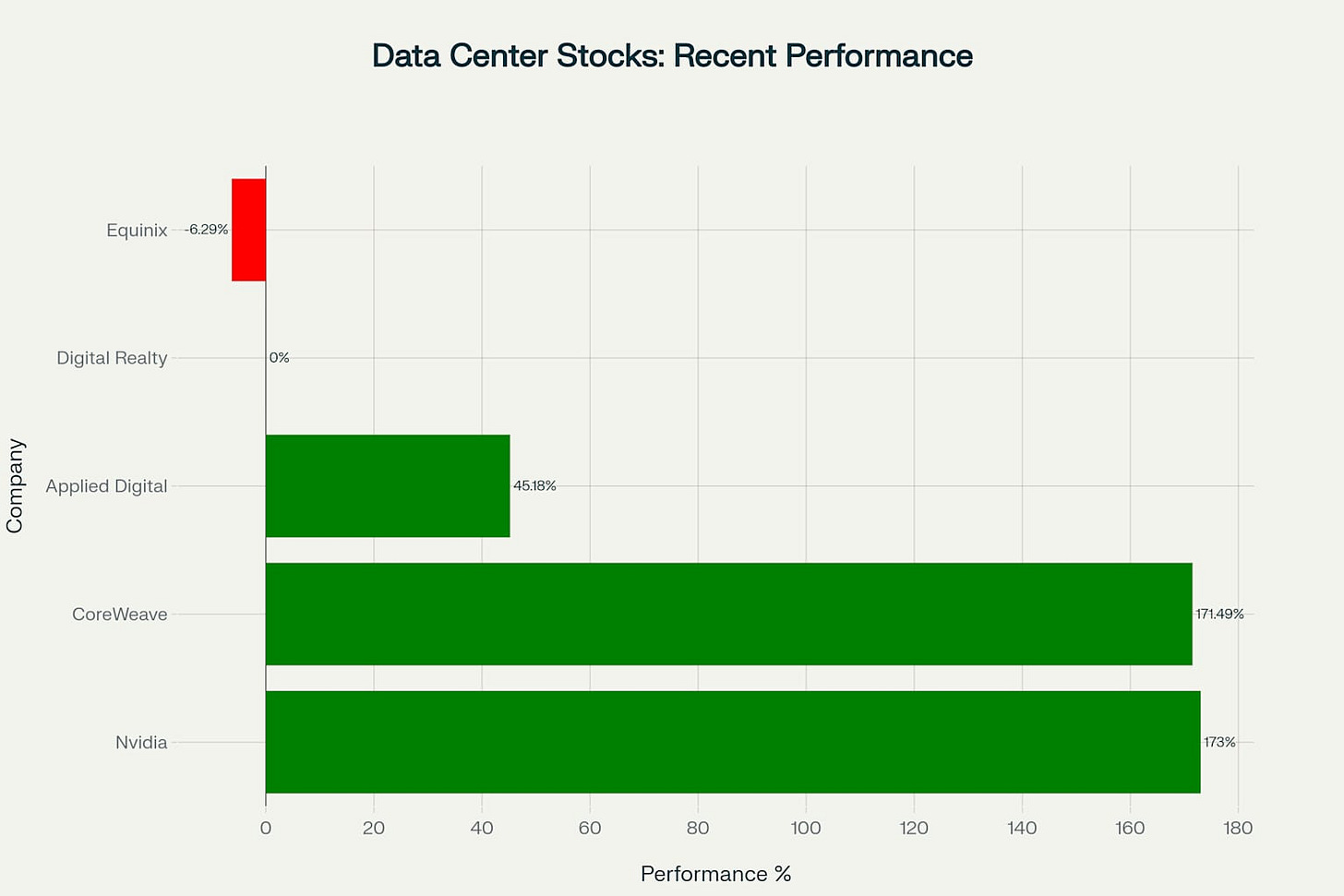

Several data center stocks have emerged as clear winners in recent trading sessions, with performance that's catching the attention of institutional investors and analysts alike 6. The standout performer has been CoreWeave (CRWV), which has surged an astounding 171.49% over the past 30 days, establishing itself as a leader in AI cloud services 6. This explosive growth reflects the company's strategic positioning in providing specialized AI data center services to hyperscale customers.

Top performing data center stocks showing recent gains led by CoreWeave and Nvidia

Applied Digital (APLD) has also been a major winner, posting a 45.18% year-to-date gain despite recent volatility 7. The company's strategic pivot toward becoming a pure-play data center REIT has created significant investor interest, particularly following its announcement to divest its cloud services division 89. This transformation story is appealing to investors who see the potential for REIT conversion and the associated benefits of lower cost of capital and higher valuation multiples.

weekly_hot_stocks_analysis.csv

Generated File

Blue-Chip Data Center REITs Show Resilience

While the high-growth names grab headlines, established data center REITs continue to demonstrate their value proposition through steady performance and analyst support 4. Digital Realty Trust (DLR) received a significant vote of confidence this week when Mizuho raised its price target from $177 to $191, citing strong rent growth prospects of 6-7% for 2025-2026 and occupancy increases of 170-200 basis points 1011.

Equinix (EQIX), despite a year-to-date decline of 6.29%, maintains strong buy ratings from 19 analysts with an average price target of $1,007.88, suggesting 13.26% upside potential 1213. The company's position as the world's largest digital infrastructure company, serving over 10,000 customers across 268 data centers globally, provides a diversified exposure to the growing demand for interconnection and colocation services 4.

Analyst price targets show significant upside potential for major data center stocks

The Nvidia Effect and AI Infrastructure

The influence of Nvidia's dominance in AI computing cannot be overstated in driving data center stock performance 1415. The company's data center revenue reaching $22.6 billion in Q1 2025, representing a 427% year-over-year increase, has created a ripple effect throughout the entire data center ecosystem 165. Supply constraints continue to be a challenge, with Nvidia indicating they expect to remain supply constrained into next year, which is actually positive for data center operators as it ensures sustained high demand for their services.

NVIDIA GPU servers within a modern data center, showcasing the robust infrastructure for advanced AI computing eziblank

Iron Mountain (IRM) exemplifies how traditional players are benefiting from this AI boom 17. The company raised its annual earnings forecast, betting on surging demand for data center leases from businesses adopting AI technologies. Revenue from its data center, digital, and asset lifecycle management segments grew more than 20% year-over-year, with AFFO rising 8% to $348 million 17.

Infrastructure Supporting Players Gain Momentum

Beyond the primary data center operators, infrastructure supporting companies are also experiencing significant growth 18. Vertiv (VRT) and Eaton (ETN) are positioned to benefit from the AI infrastructure boom through their power and cooling solutions essential for data center operations. The growing power demands of AI workloads are creating substantial opportunities for companies that can provide efficient cooling and power management systems.

A long aisle within a modern data center lined with rows of high-density GPU server racks servethehome

The sector's growth is further supported by the transition from AI training to AI inference, which is expected to drive demand for edge computing and smaller, distributed data centers 4. This trend could benefit companies with diverse geographic footprints and the ability to serve both hyperscale and enterprise customers.

data_center_stocks_comparison.csv

Generated File

Investment Risks and Considerations

While the data center sector presents compelling growth opportunities, investors should be aware of several risk factors 4. The cyclical nature of the technology sector means that current AI-driven demand could potentially moderate if artificial intelligence fails to deliver demonstrable ROI over time. Power constraints and supply chain issues are forcing companies to make capacity decisions years in advance, which could lead to overcapacity if demand patterns shift.

Interest rate sensitivity remains a concern for data center REITs, as significant upward moves in rates since many assets were financed have created bid-ask spreads that could limit trading activity 3. Additionally, the high valuations of some stocks, particularly those with strong recent performance, suggest that much of the positive news may already be reflected in current prices.

Looking Ahead: Catalysts and Opportunities

The data center sector's outlook remains robust for the next 12-24 months, driven by hyperscale expansion and continued cloud migration 4. Key opportunities include capitalizing on AI demand expansion, developing colocation services for inference workloads, and expanding into secondary markets where AI inferencing demand is expected to grow.

The transition to AI inferencing represents a particularly significant opportunity, as it requires different infrastructure characteristics than training workloads and may benefit from edge deployment strategies 4. Companies with software-driven networking capabilities and established customer relationships are well-positioned to develop new tools and services to support the complexity of AI deployments.

Server racks in a data center with hardware and cooling systems siliconangle

Conclusion

The data center sector is experiencing a once-in-a-generation transformation driven by artificial intelligence infrastructure requirements. While CoreWeave's 171% surge and Applied Digital's transformation story capture attention, the entire ecosystem from established REITs like Equinix and Digital Realty to infrastructure providers like Vertiv and Eaton are benefiting from this unprecedented demand.

Investors should approach this sector with a balanced perspective, recognizing both the substantial growth opportunities and the inherent risks of investing in a rapidly evolving, high-growth market. The companies best positioned for long-term success will be those that can efficiently scale their operations, maintain strong customer relationships, and adapt to the evolving needs of AI infrastructure deployment.

With global data center market growth projected at 8.37% annually through 2029 and US financing expected to double in 2025, the fundamental drivers supporting this sector appear robust and sustainable 21. For investors seeking exposure to the AI revolution, data center stocks offer a compelling way to participate in this transformative technological shift.

https://money.usnews.com/investing/articles/best-data-center-stocks

https://finance.yahoo.com/news/high-growth-tech-stocks-us-173830065.html

https://www.projectfinance.law/publications/2025/june/data-center-financing-structures/

https://investor.equinix.com/stock-information/historical-data

https://www.nasdaq.com/market-activity/stocks/eqix/historical

https://finance.yahoo.com/news/mizuho-remains-bullish-data-centers-065636804.html

https://www.macrotrends.net/stocks/charts/DLR/digital-realty-trust/stock-price-history

https://www.reitnotes.com/reit/CoreSite-Realty-Corporation/symbol/COR

https://www.marketscreener.com/quote/stock/CORESITE-REALTY-CORPORATI-6645638/

https://www.morningstar.com/markets/weekly-market-update-stock-gainers-losers

https://www.forbes.com/sites/investor-hub/article/best-growth-stocks-buy-now-june-2025/

https://www.cooperfarmsgrain.com/news/story/30115441/5-ai-data-center-stocks-to-buy-for-2025

https://visiblealpha.com/blog/data-center-revenue-growth-continues-nvidias-fiscal-q1-2025-earnings/

https://www.zacks.com/commentary/2504768/ai-infrastructure-boom-2-companies-poised-to-benefit

https://nvidianews.nvidia.com/_gallery/download_pdf/664e53fe3d63322459a5eff6/

https://www.valuewalk.com/news/nvidia-deal-fuels-5-spike-for-this-ai-data-center-stock/

https://www.credaily.com/briefs/data-centers-lead-reit-investment-surge-with-low-cap-rates/

https://www.wsj.com/market-data/quotes/EQIX/research-ratings