The Data Center Gold Rush: Mind-Blowing Numbers That Show How AI Is Reshaping Our Digital Infrastructure

The hyperscaler spending war has reached astronomical heights, with trillion-dollar projections and energy consumption that rivals entire nations

The data center industry in 2025 isn't just experiencing growth—it's witnessing a full-blown infrastructure revolution that's redefining the scale of human technological ambition. From hyperscalers spending over $300 billion annually to data centers consuming as much electricity as entire countries, the numbers emerging from this sector are nothing short of staggering.

An aisle within a large-scale data center, showcasing rows of densely packed server racks (servethehome)

The $370 Billion Spending Spree

The hyperscaler capital expenditure arms race has reached unprecedented levels in 2025, with the biggest tech companies collectively committing over $370 billion to data center infrastructure this year alone1. This represents a jaw-dropping 50% increase from 2024, driven almost entirely by artificial intelligence demands.

Hyperscaler CapEx projections for 2025 showing the massive AI infrastructure investment race

Amazon Web Services leads this spending tsunami with a mind-boggling $100 billion commitment, followed by Microsoft at $80 billion and Google at $75 billion23. To put this in perspective, AWS's 2025 infrastructure spending alone exceeds the entire GDP of most countries.

But the real kicker? This is just the beginning. McKinsey projects that global data centers will require $6.7 trillion in capital expenditures by 2030 to keep pace with compute demand—a number so large it's difficult to comprehend4.

The AI Capacity Explosion

The driving force behind this unprecedented spending is artificial intelligence, and the numbers are mind-blowing. AI workloads are set to dominate 70% of all data center capacity by 2030, growing from 44 gigawatts in 2025 to a staggering 156 gigawatts by decade's end5.

Global data center capacity demand showing the explosive growth of AI workloads from 2025 to 2030

This represents a 3.5x increase in AI-specific infrastructure in just five years. Meanwhile, traditional non-AI workloads will grow at a comparatively modest pace, from 38 GW to 64 GW5. The implications are clear: we're witnessing the birth of an entirely new category of digital infrastructure designed specifically for artificial intelligence.

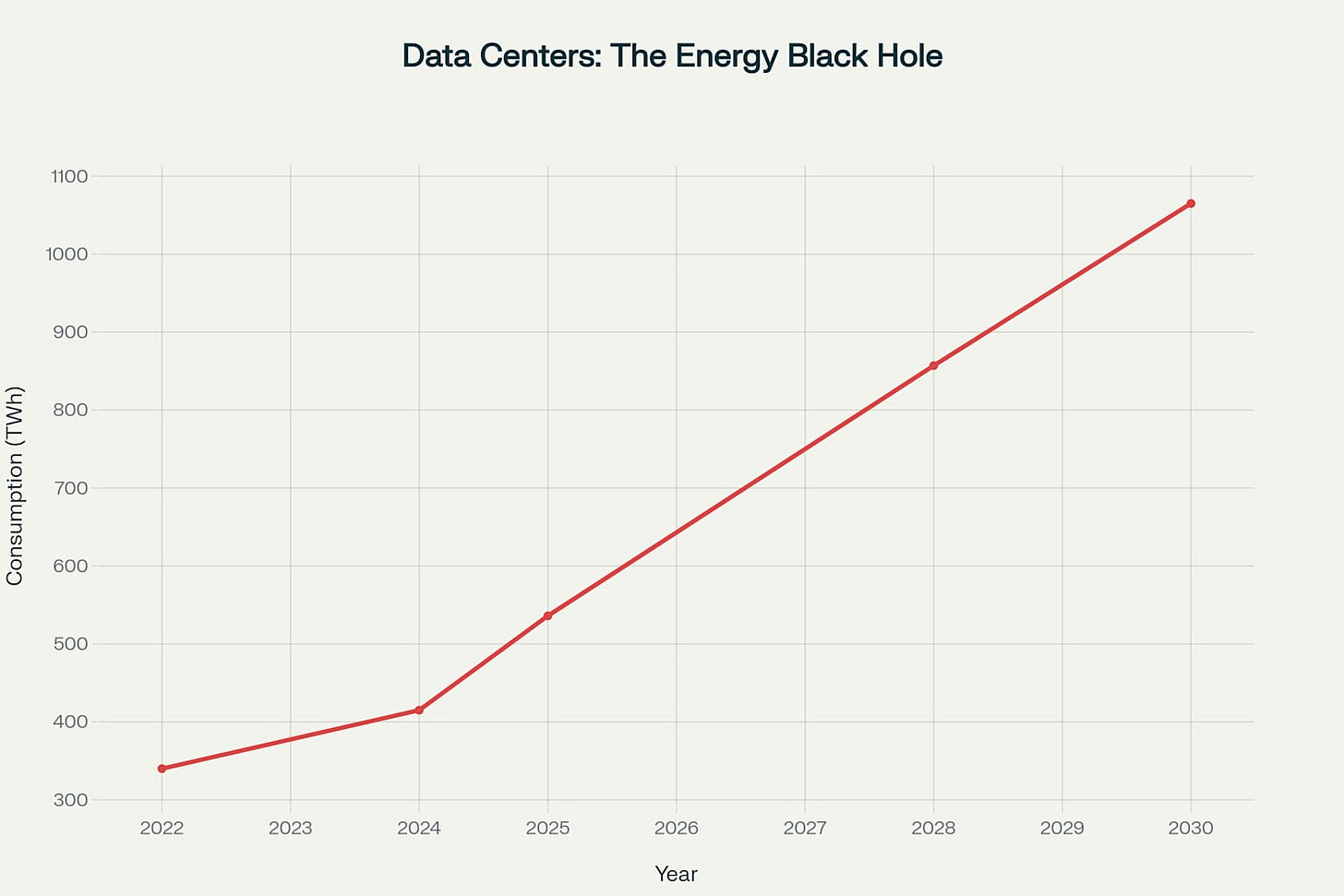

Energy Consumption That Rivals Nations

Perhaps the most shocking statistics relate to energy consumption. Data centers are projected to consume 1,065 terawatt-hours of electricity by 2030—enough to power the entire nation of Japan for a full year67.

Global data center electricity consumption showing explosive growth from 2022 to 2030

Currently representing about 2% of global electricity demand, data centers are on track to consume 4% of all electricity generated on Earth by 203089. In the United States alone, data center electricity consumption is expected to reach 857 TWh by 2028—equivalent to powering 7.7 million American homes8.

Nuclear Power Makes a Dramatic Comeback

The energy demands are so extreme that they're driving a renaissance in nuclear power. Microsoft's 20-year, $1.6 billion deal to restart the infamous Three Mile Island nuclear plant represents just the tip of the iceberg1011. The 837-megawatt facility will provide enough clean energy to power 800,000 homes, but Microsoft is taking 100% of the output for its data centers.

Aerial view of the Three Mile Island nuclear power plant, illustrating a significant energy source that could power large data centers (penncapital-star)

Amazon has joined the nuclear rush with a $650 million acquisition of a data center campus directly connected to Pennsylvania's Susquehanna nuclear plant, while Oracle is planning a 1-gigawatt data center campus powered by three small modular reactors1012.

NVIDIA's Blackwell Bonanza

The chip shortage and AI hardware demand have created some of the most extreme statistics in the industry. NVIDIA's data center revenue exploded by an almost incomprehensible 427% year-over-year, jumping from $4.28 billion to $22.57 billion in a single quarter13.

NVIDIA GPU server racks illuminate a modern data center, representing the physical infrastructure of AI and hyperscale computing (eziblank)

The company's newest Blackwell Ultra chips are so coveted that "the entire 2025 production is already sold out," according to Morgan Stanley analysts14. These chips pack 208 billion transistors and can deliver 15 petaflops of performance—numbers that would have been science fiction just a few years ago15.

An NVIDIA DGX GB200 NVL72 rack system, a high-density AI server, displayed in a data center or exhibition setting (theregister)

Real Estate Goes Hyperdrive

The land grab for data center real estate has reached fever pitch. Northern Virginia alone has 15.4 gigawatts in its development pipeline, while the global data center market is projected to explode from $347 billion in 2024 to over $1 trillion by 20271613.

Data center vacancy rates have plummeted to a record-low 2.8%, with new construction achieving 90% pre-leasing rates—unprecedented in commercial real estate17. Land prices in prime markets have skyrocketed, with "powered land" (land with pre-secured utility commitments) commanding premium prices as developers compete with electric vehicle manufacturers and chip companies for suitable sites16.

Water Usage That's Hard to Fathom

The cooling requirements for these massive facilities are creating their own crisis. A typical 100-megawatt data center consumes approximately 2 million liters of water daily—equivalent to the water usage of 6,500 households1819.

Globally, data centers consume about 560 billion liters of water annually, with projections reaching 1.2 trillion liters by 203018. To put this in perspective, that's enough water to supply the entire city of Los Angeles for nearly two years.

A conceptual depiction of liquid cooling for server units in a modern data center environment (andcable)

The Construction Boom

The physical scale of construction is equally staggering. Microsoft's data center campus in Wisconsin spans 315 acres with a $1 billion price tag, while Oracle's "Stargate" project represents a $40 billion investment in NVIDIA chips alone2021.

NTT Global Data Centers is investing $10 billion to deliver over 370 megawatts of new capacity globally, while Amazon announced a $20 billion expansion in Pennsylvania that will create 1,250 high-skilled jobs2112.

The Human Impact

Perhaps most remarkably, this digital infrastructure boom is reshaping electricity markets for ordinary consumers. Data centers' voracious appetite for power is projected to increase electricity bills for American households by up to 20% in some regions, as utilities pass infrastructure costs to all ratepayers2223.

Looking Ahead: A $7 Trillion Question

As we approach the midpoint of 2025, one thing is clear: we're witnessing the largest infrastructure buildout in human history. The $6.7 trillion projected investment through 2030 dwarfs the Interstate Highway System, the Apollo program, and the Manhattan Project combined4.

Whether this unprecedented investment will generate the promised returns remains to be seen. Goldman Sachs has warned that while $1 trillion will be spent on AI infrastructure over the next few years, it's unclear whether it will generate the financial returns people are hoping for24.

What's certain is that we're living through a technological transformation of unprecedented scale and speed. The numbers don't just represent financial investments—they represent humanity's bet that artificial intelligence will fundamentally reshape our world.

And judging by these statistics, that bet is all-in.

The data center revolution is just getting started. As AI workloads continue to explode and new technologies like quantum computing emerge, expect these already mind-bending numbers to keep growing. The only question is: can our planet's resources keep up with our digital ambitions?

https://www.visualcapitalist.com/charted-the-growth-of-global-data-center-capacity-2005-2025/

https://www.marketreportanalytics.com/reports/hyperscalers-market-9997

https://www.mckinsey.com/featured-insights/sustainable-inclusive-growth/charts/data-center-demands

https://www.itconvergence.com/blog/top-strategic-cloud-computing-predictions-for-2025-and-onwards/

https://gbc-engineers.com/news/top-5-hyperscale-data-center-companies-in-2025

https://www.cbre.com/insights/reports/global-data-center-trends-2025

https://datacenterhawk.com/resources/market-insights/1q-2025-data-center-market-recap

https://www.futuriom.com/articles/news/hyperscaler-capex-could-drop-27-next-year/2025/04

https://www.simplilearn.com/trends-in-cloud-computing-article

https://jedunn.com/the-look-ahead/advanced-facilities-group/ai-data-center-energy-concerns/

https://www.datacenters.com/news/real-estate-trends-buying-land-for-data-center-development-in-2025

https://www.linkedin.com/pulse/hyperscalers-dreaming-simplicity-2025-how-achieve-guy-massey-zwd9c

https://patentpc.com/blog/the-ai-chip-boom-market-growth-and-demand-for-gpus-npus-latest-data

https://nvidianews.nvidia.com/news/nvidia-blackwell-platform-arrives-to-power-a-new-era-of-computing

https://datacenterpost.com/maintaining-data-center-uptime-critical-challenges-and-solutions-in-2025/

https://www.datacenterknowledge.com/data-center-construction/new-data-center-developments-june-2025

https://www.canalys.com/insights/channel-partner-investment-in-cloud-hyperscalers

https://www.nvidia.com/en-us/data-center/technologies/blackwell-architecture/

https://blog.gridstatus.io/byte-blackouts-large-data-center-loads-new-issues-pjm/

https://www.xyzreality.com/resources/data-center-rundown-may-2025

https://www.upsite.com/blog/data-center-cooling-trends-for-2025/

https://propertymanagerinsider.com/2025-data-center-construction/

https://www.kwant.ai/blog/rise-of-data-center-construction-key-players-and-market-insights

https://www.cbre.com/insights/books/us-real-estate-market-outlook-2025/data-centers

https://blog.consoleconnect.com/whats-new-with-google-cloud-for-2025

https://www.bloomberg.com/graphics/2025-ai-impacts-data-centers-water-data/

https://www.npr.org/2024/09/20/nx-s1-5120581/three-mile-island-nuclear-power-plant-microsoft-ai

https://siliconangle.com/2025/04/12/googles-cloud-play-integrated-ai-infrastructure-apps/

https://gfmag.com/economics-policy-regulation/microsoft-three-mile-island-nuclear-power-ai-demand/

https://www.aboutamazon.com/news/aws/amazon-data-center-investment-in-australia

https://cloud.google.com/blog/topics/google-cloud-next/welcome-to-google-cloud-next25

https://www.wired.com/story/new-research-energy-electricity-artificial-intelligence-ai/

https://www.crn.com/news/data-center/2025/data-center-50-the-hottest-data-center-companies-of-2025

https://hackernoon.com/4-issues-exacerbating-the-looming-ai-chip-shortage

https://finance.yahoo.com/news/data-center-market-size-hits-103000410.html

https://www.datacenterdynamics.com/en/news/morgan-stanley-hyperscaler-capex-to-reach-300bn-in-2025/

https://www.cbsnews.com/news/artificial-intelligene-ai-data-centers-electricity-bill-energy-costs/

https://sourceability.com/post/ai-chip-shortages-deepen-amid-tariff-risks

https://datacentremagazine.com/top10/top-10-biggest-data-centres

https://floodlightnews.org/power-for-data-centers-could-come-at-staggering-cost-to-consumers/

https://www.blackridgeresearch.com/blog/top-data-center-companies-in-usa-united-states

https://intelligence.supplyframe.com/whats-ahead-for-semiconductor-supply-chains-in-2025/